owner's draw vs salary

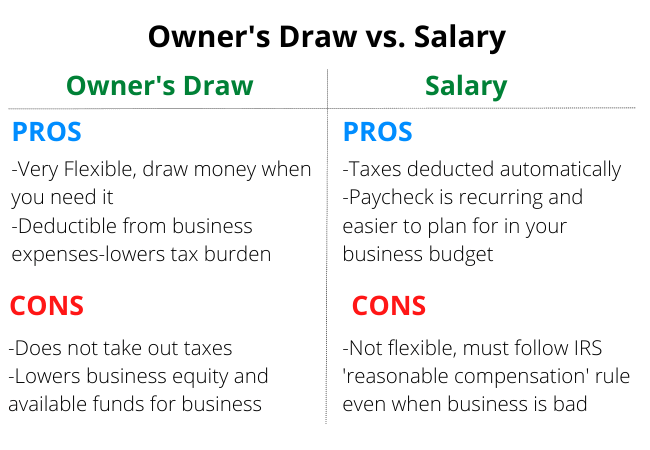

However you will be able to take. While there are other ways business owners pay themselves an owners draw or a draw and taking a salary are the two most.

How To Pay Yourself From An Llc 2022 Guide Forbes Advisor

Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA.

. Owners Draw Vs Salary Llc. Suppose the owner draws 20000 then the. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

Your two payment options are the owners draw method and the salary method. On the opposite end S Corps dont pay self-employment tax. Owners draw or salary.

In the former you draw money from your business as and when you see fit. How to pay yourself. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. There are two main ways to pay yourself. Understand how business classification impacts your.

The draw method and the salary method. Owners Draw vs. Many small business owners compensate themselves using a draw rather than paying.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. But between unsteady profits pouring money back into the business and simply not knowing how much is fair to take most business owners. With the draw method you can draw money from your.

Small business owners paying themselves a salary collect a W-2 and pay those taxes through wage withholdings. An owners draw refers to an owner taking funds out of the business for personal use. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

Understand the difference between salary vs. Salary is the recurring payment that you receive every month just like an employee. This post is to be used for informational purposes only and.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. The business owner takes funds out of the business for. You can pay yourself from an LLC in the form of salary or the owners draw.

Salary method vs. Owners draws can be scheduled at regular intervals or taken only. Difference Between Owners Draw and Salary.

You dont need a salary because you.

![]()

Pay Yourself Right Owner S Draw Vs Salary Onpay

How To Pay Yourself As A Business Owner Nerdwallet

Owner S Draw Vs Salary What S The Difference 1 800accountant

Do You Pay Yourself As A Small Business Owner How Workful

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk

Does An Owner Draw Count As Salary For The Paycheck Protection Program Ppp Nav

Salary Vs Draw How To Pay Yourself As A Business Owner South Africa Small Business Centre

Cpa Explains Self Employed Owner Compensation Salary Vs Owner S Draw Sole Prop Llc Partner Youtube

Owner S Draw Vs Salary What Is An Owner S Draw Nav

All About The Owners Draw And Distributions Let S Ledger

Salary Vs Draw How To Pay Yourself As A Small Business Owner

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

How To Pay Yourself As An Llc Owner In 2023 Incfile

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

How To Pay Yourself As A Business Owner Smallbizgenius

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

How To Set Your Own Salary Small Business Owner Salary Calculator Gusto

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Article

:max_bytes(150000):strip_icc()/smallbusinessownerpayinghimselfpaycheck-af2453e3519b47bd9361501f901d6565.jpg)